s corp tax savings calculator

Forming an S-corporation can help save taxes. AS a sole proprietor Self Employment Taxes paid as a Sole.

Tax Liability What It Is And How To Calculate It Bench Accounting

From the authors of Limited Liability Companies for Dummies.

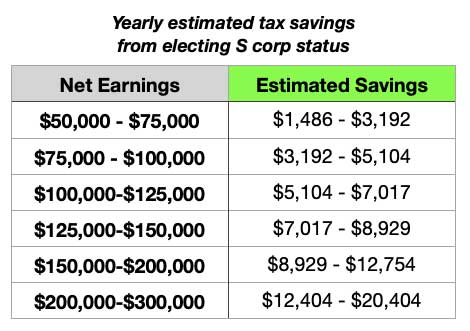

. Use this calculator to get. As we explain below you may be able to reduce your tax bills by creating an S corporation for your business. Here is an illustration that offers insights into a comparison drawn between the S corp and a sole proprietorship.

1 Select an answer for each question below and we will calculate your S-corp tax savings. Moving to S-Corp can save you thousands of dollars each year on taxes. We shall be looking at this comparison in terms of the taxes that can be saved.

Scores are presented in relation to the national average of 100. Adjustable Rate Mortgage Calculator - This calculator helps you to determine what your adjustable mortgage payments will be. LLC Taxes Discover your LLCs total taxes effective rate and potential savings.

If its over 100 its more expensive than the national. By opting for an S Corp election the company andor. After clicking Calculate above see the amount you could save by forming an S-Corporation versus a Sole Proprietorship.

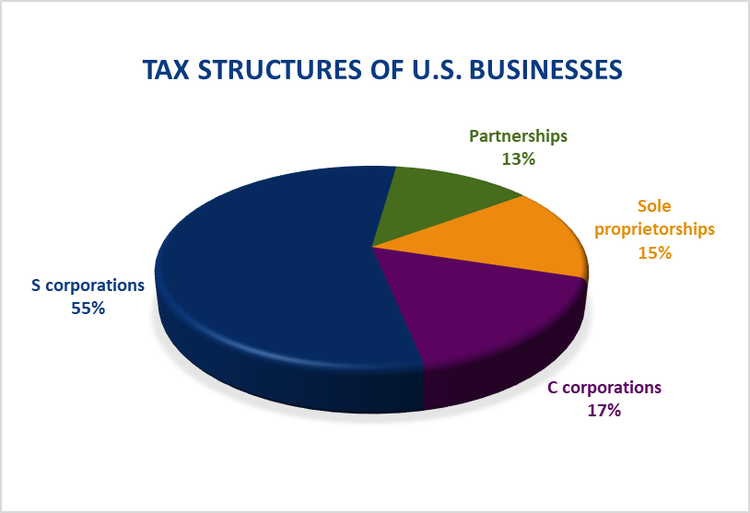

A What is your. S Corporations are also a popular entity formation choice for small businesses or freelancers with profits between 80000 and 100000. The SE tax rate for business owners is 153 tax.

OLPMS - Instant Payroll Calculator. Self Employment Find out. You must decide how to officially establish your firm for tax and legal reasons as a company owner.

This calculator helps you estimate your potential savings. Gross to Net Net to Gross Tax Year. If a places COL index is below 100 its cheaper than the national average.

We are not the biggest. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. For example if your one-person S corporation makes 200000 in profit and a.

Free Phone Evaluation - Call 201 587-1500 212 380-8117 - Samuel C Berger PC is dedicated to serving our clients with a range of legal services including S Corporation and Limited. Calculating Your S-Corp Tax Savings is as Easy as 1-2-3. We automate the creation and ongoing management of S.

Because it is a simple company structure to organize and run many. S Corps S Corp guides resources and calculators for saving taxes.

S Corp Rias Disadvantaged By The Tax Bill Mercer Capital

Tax Calculator Return Refund Estimator 2022 2023 H R Block

S Corp Vs C Corp Which Is Right For Your Small Business

Corporate Tax In The United States Wikipedia

What Is An S Corporation And Should You Form One Bench Accounting

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Here S How Much You Ll Save In Taxes With An S Corp Hint It S A Lot

![]()

S Corp Tax Savings Calculator Ask Spaulding

Llc Tax Calculator Definitive Small Business Tax Estimator

Use This S Corporation Tax Calculator To Estimate Taxes

Guide To Calculating Cost Basis Novel Investor

S Corp Tax Secrets Tax Savings Strategies 2023 White Coat Investor

Llc And S Corporation Income Tax Example Tax Hack

Taxation Of An S Corporation The Why Benefits How Rules

What Is An S Corp Reasonable Salary How To Pay Yourself The Right Way Collective Hub

:max_bytes(150000):strip_icc()/GettyImages-532459366-575ea5ec5f9b58f22e8cd8bf.jpg)